Estate Planning

Estate PlanningThe period surrounding the loss of a loved one is always a difficult time. When all you want is time to grieve, administering a deceased estate can be seriously challenging. With this in mind, we have put together a guide to help walk you through the basic steps involved in administering a deceased estate…

The dirty laundry of a wealthy Sydney family has been aired in court during a battle over the colourful 90-year-old matriarch’s multimillion-dollar fortune…

Australian taxpayers are “bound to” be hit with an inheritance tax, Chief of financial advice firm Stanford Brown, Jonathan Hoyle has said, pointing to similar policies in the UK and US…

How would you feel if your estate went to a complete stranger, someone you’d never even met, instead of going to your children? It’s more likely than you might expect. Protecting your children’s inheritance is about good planning – and that can only happen through pragmatic awareness and recognition of what is legally possible…

The daughter of Bob Hawke is reportedly mounting a legal challenge against Blanche d’Alpuget over his will, two months after his death…

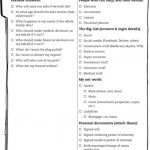

Scott Pape from the Barefoot Investor has suggested that we all prepare a ‘fearless folder’ in the event of our untimely death, so that our family will know all our expectations and social media details not found in a traditional Will…

While more Australians are aware of the importance of having a will, simply buying a do-it-yourself will kit from a newsagent and filling it out yourself can cause more problems than it solves.

..

The Selths believe their testamentary trust strategy will make it more transparent and equitable for all beneficiaries. “We had a will but it didn’t embrace everything we wanted. We knew where we wanted the money to go but we wanted to be sure the beneficiaries were our kids but that they were protected in the case of divorce.”..

For chartered accountant Kylie Parker, who is about the embark on her third marriage, making sure there is a record of what is brought into the union is top-of-mind…

Half of all Australians die without a will, according to the Australian Securities and Investments Commission, meaning the law decides where your assets go, potentially favouring relatives you resent.

Making a will is vital, but can cost from $150 to thousands of dollars, if you use professional channels. Here are some tips on how to do it yourself, with intense attention to detail…