Family Tax Benefit Part A

Family Tax Benefit Part AA married couple have chosen to live in Lebanon, but have frequented Australia for the birth of each of their children, solely for the purpose of claiming a raft of family-based welfare payments…

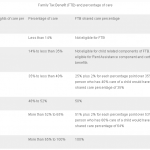

This factsheet explains how Family Tax Benefit (FTB) works when the care of children is shared, most frequently in the event of divorce or separation. It also explains how to deal with problems that can arise, particularly when two carers do not agree on the “percentage of care” that should apply…

The baby bonus has been scrapped in the federal budget. The Howard-era payment that provides $5000 for newborns will be replaced with a much lower payment.

..

Sending a child to school is an expensive business, even if they go to a public school – there’s the uniform, the bags, the stationery, the shoes and so on. State and Federal governments recognise that school and going back to school at the beginning of the year can be an expensive time for parents and have some refunds and payments in place. Here are a few…

The new back to school bonus government scheme has just been rolled out with 1.2 million families who are eligible for Family Tax Benefit Part A receiving up to $820 a year per child for education-related expenses. ..

PARENTS can expect a back-to-school January cash splash from the Gillard government with payments of up to $820 for every child…

FOUR hundred thousand families must notify Centrelink in the next month if their child is starting primary school or moving to high school next year so they don’t miss out on the school kids bonus worth up to $820 per child…