In my blog site at the Family Law Web Guide I wrote recently on the confusion surrounding what ‘other’ payments can be accepted by Child Support where a payer (usually a father) is paying child support to a payee (usually a mother) and where the payee does not agree that the payment made by the payer is for the support of the child(ren) or in other words… is paid as child support.

Where parents agree there is no problem and anything is possible. HOWEVER in the main most people when it comes to money matters don’t agree. Certainly those that are separating and come to the Family Law Web Guide often never agree that the sun has risen on a new day and so it is with Child Support.

Firstly some good news and some bad news.

The good news is that yes you can claim some types of expenses that are paid in lieu of child support and some of those are of a type that does not require the other parent to agree they were in lieu of Child Support.

The bad news is, that the payer has to have less than 14% care of all of the children and meet other requirements set out below.

The legislation also provides for prescribed payments under section 71C. If the payment was of a kind specified in regulation 5D (known as a ‘prescribed payment’) the Registrar can credit the payment up to a maximum amount that is equal to 30% of the amount payable under the payer’s liability for the period only if:

- -the payer of an enforceable maintenance liability in relation to a payment period or initial period has made one or more payments to the payee of the liability, or to another person; and

- -the payment is a payment of the kind specified in regulation 5D; and

- -the sum of those payments exceeds the sum of all such payments previously credited under this section against the liability for all past periods; and

- -at the time the payment was made the payer has less than 14% care of all of the children to whom the relevant administrative assessment relates; and

- -at the time the payment was made the child support liability was not being fully or partially met by a lump sum credit (sections 69A, 71C(2) and 71C(5)(b)); and

- -the liability is not a parentage overpayment order or spousal and de facto maintenance order (section 71C(5)(a)), or a registrable overseas maintenance liability (section 71C(6)).

We are seeing a number of things going on here.

Payees are running Change of Assessment applications and have been ensuring the Payer does not get 14%, but gets 15% time allocated. One would be presumptuous to assume a payee is aware of the 14% rule.

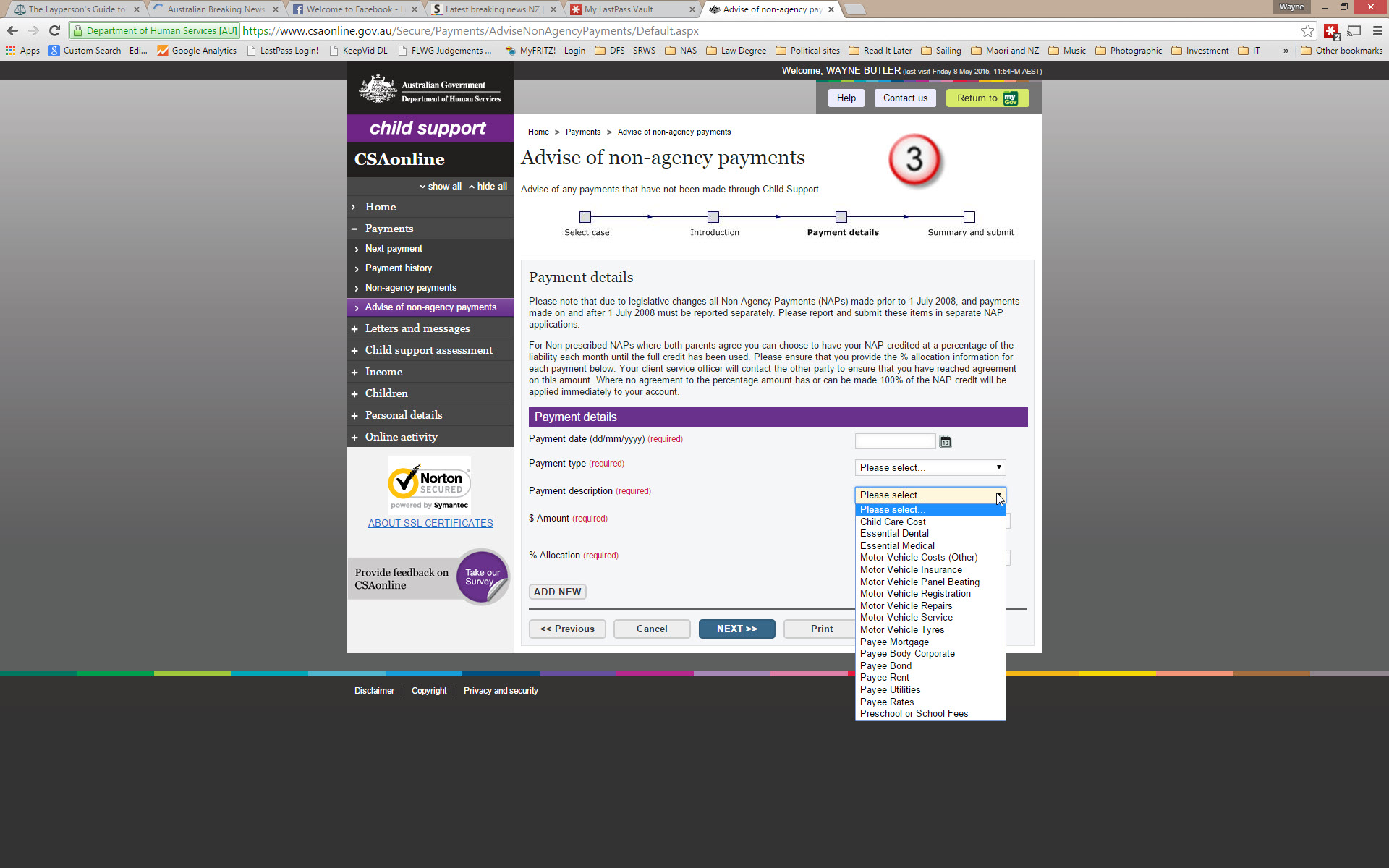

The claims able to be made also include Mortgage Payments (See the drop down list in the on line Child Support payments gateway on MyGov )

Prescribed non-agency payments

The Registrar can credit certain payments towards a payer’s child support liability regardless of the intention of the parents at the time the payment was made (section 71C), except if:

- -the liability is an overseas maintenance liability (section 71C(6)); or

- -the liability is a parentage overpayment order, or for spousal or de facto maintenance (section 71C(5)(a)); or

- -at the time the payment was made the payer had at least regular care of any of the children to whom the relevant administrative assessment relates; or

- -at the time the payment was made the child support liability was being fully or partially met by a lump sum credit (Refer to 5.3.3 Crediting Lump Sum Payments)

Credit can be given up to a maximum of 30% of the ongoing liability, provided:

- -the balance of child support is paid as it becomes due and payable;

- -the payer has less than 14% care of all of the children to whom the relevant administrative assessment relates at the time the credit is being applied (section 71C(1)(d); and

- -the child support liability is not already being met by a lump sum credit.

The balance can be paid in cash or in the form of a non-agency payment credited under s71 or s71A, or from money credited from another source such as a tax refund or payment from a third party.

The Registrar can only credit amounts paid on or after 1 July 1999.

The types of payments that can be credited in this way are listed or ‘prescribed’ by regulation (regulation 5D). They are:

- –child care costs for the child who is the subject of the enforceable maintenance liability;

- –fees charged by a school or preschool for that child;

- –amounts payable for uniforms and books prescribed by a school or preschool for that child;

- –fees for essential medical and dental services for that child;

- –the payee’s share of amounts payable for the payee’s home; and

- –the costs to the payee of obtaining and running a motor vehicle, including repairs and standing costs.

I note that the descriptions are much wider in the drop down lists than in the published material through the Guide. I can only assume that the list represents the sort of claims being made and those additional items that are not in the prescribed Non Agency Payments list are agreed Non Agency Payments. That is something we need to look further into.

For example:

- -Child Care cost

- -Essential dental

- -Essential Medical

- -Motor Vehicle Costs (Other)

- -Motor Vehicle Insurance

- -Motor Vehicle Panel Beating

- -Motor Vehicle Registration

- -Motor Vehicle Repairs

- -Motor Vehicle Service

- -Motor Vehicle Tyres

- -Payee Mortgage

- -Payee Body Corporate

- -Payee Bond

- -Payee Rent

- -Payee Utilities

- -Payee Rates.

My view has always been that these sorts of payments should be able to be credited as Prescribed Non Agency payments regardless of the level of care. That is, it does not matter if you have 10%, 14% or 40% care. If a payer wants to make a prescribed payment directly to an establishment for the purposes of Child Support then they should be able to do so. It is all about empowering parents to contribute to Child Support.

Those parents that pay for something that is tangible and can be seen as benefiting the child(ren) directly are empowered and far more engaged than those who pour money into a bottomless pit that is never accounted for, and where the other parent, in a number of cases has spent the child support money on other than the child(ren).

I will be writing further in my next blog about Superannuation and the trap for those between 60 and 65 who get excited about setting up a TAP. My hint until next time is that if you are in the Child Support system then avoid at any cost setting up a Transition to Retirement plan. As well we will address the issues of Redundancy and Self employed in the fullness of time. All of these subjects are dear to our heart and have many forum topics raised in our forums here.

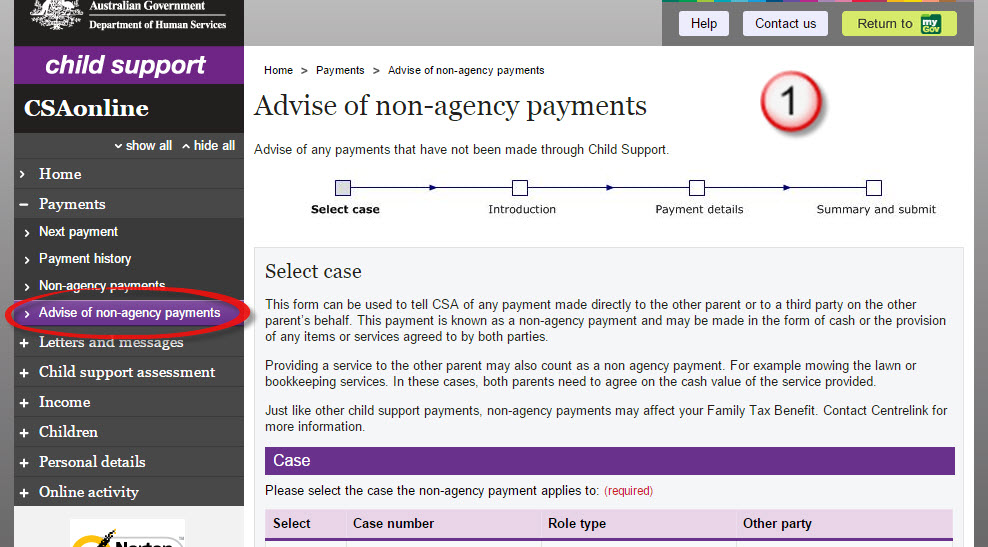

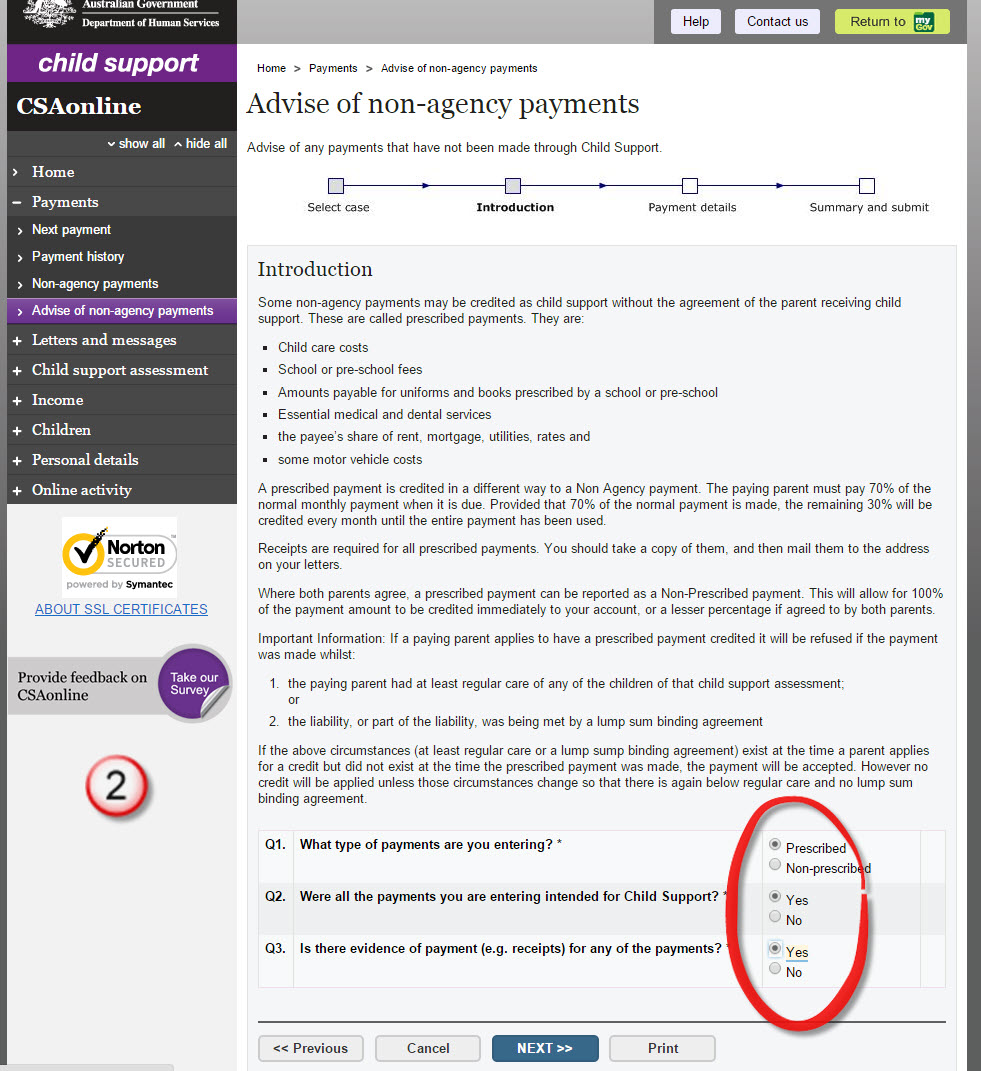

Just to finish off here are some screen shots from the Prescribed non-agency payments to help navigate your way in making applications.

Key takeouts here are:

< 14% care (Less than 14% care)

Prescribed = where the other parent doesn’t agree

Non Agency Payments can be agreed or Prescribed Non Agency Payments NOT agreed between the parents.

Related Family Law Judgments